TURNOVER TAX DECLARATION

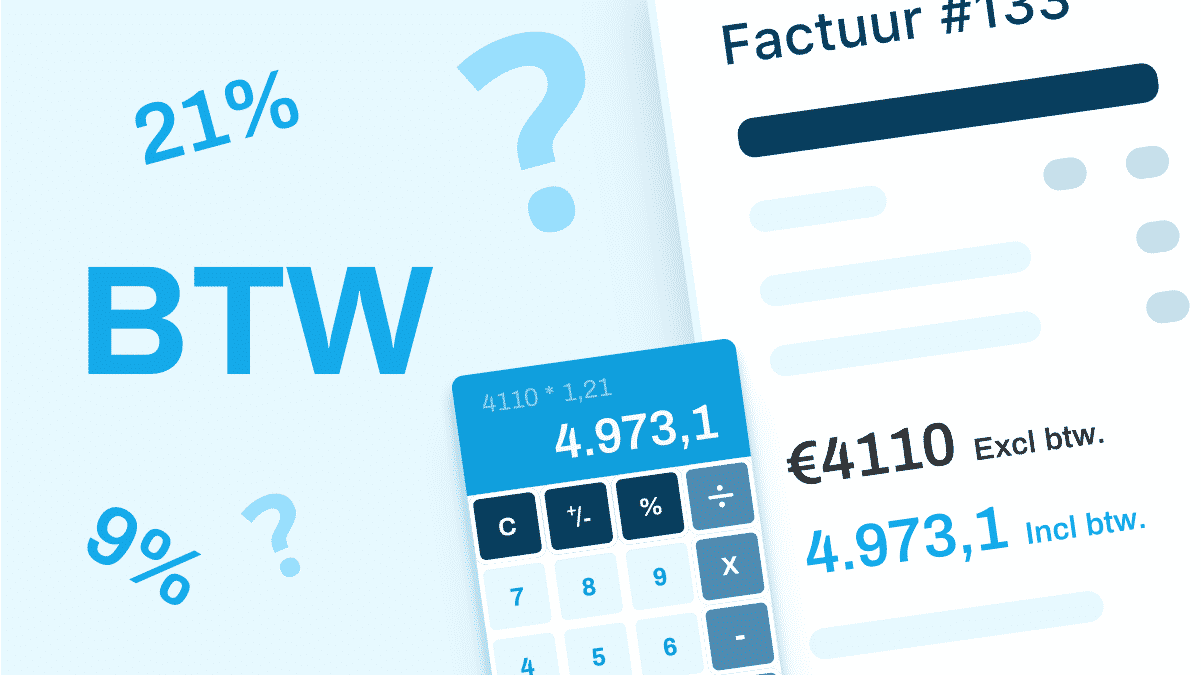

VAT (sales tax)

Sales tax is an indirect tax imposed by a government on the sale of products or services. Are you an entrepreneur, independently practicing a business or profession? Then you usually pay VAT (sales tax) on your sales. The legal form (e.g., bv or nv) is not important for paying VAT. A foundation or association also pays VAT if the tax authorities consider it a business. You do not pay VAT if you only perform exempt work or use the small business scheme (KOR).

When are you an entrepreneur for VAT purposes?

The tax authorities do not automatically consider you to be an entrepreneur for VAT purposes. The conditions for VAT are different than for income tax. Thus, you may be an entrepreneur for VAT purposes, but not for income tax purposes. Are you an entrepreneur for VAT purposes? Then you will get a sales tax number and a VAT identification number (VAT ID). You are required to put your VAT identification number on your invoices. You should also keep a record of all invoices sent and received.

VAT declaration

You have been required to file your VAT return digitally since 2012. Did you declare too much or too little VAT this year or over the past 5 years? Then you must correct your VAT return.

You can choose to send in your tax return via the Tax Administration’s website or with special tax return software. On the site of the tax authorities you can read how to fill in and send in your VAT declaration. It is possible, under certain conditions, to offset a VAT refund against a payroll tax return.

When do I need to file VAT returns?

The rules for filing a tax return are set by the Tax Administration:

![]() If you file a quarterly or monthly return, you must file your return no later than the last day of the next month following the filing period

If you file a quarterly or monthly return, you must file your return no later than the last day of the next month following the filing period

![]() Do you file a tax return per year? Then file your tax return before April 1 of the next year.

Do you file a tax return per year? Then file your tax return before April 1 of the next year.

It is important to file a tax return on time. If you do this too late, you will receive an additional assessment and may have to pay a fine to the tax authorities.

VAT when outsourcing work (reverse charge)

Are you outsourcing work to another entrepreneur? If so, it must pay the VAT for this to the tax authorities. In some cases, a reverse charge mechanism applies. The VAT will then be “shifted” to you. That means you have to declare and pay the VAT yourself. The entrepreneur indicates this on the invoice.

No VAT with the small entrepreneurs scheme (KOR)

Does your business have a turnover of up to €20,000 per year? If so, you may be able to take advantage of the small business rule (KOR). If you use the KOR, you do not charge VAT to your customers. In addition, you no longer file a VAT return, with a few exceptions. Participating in the KOR also means that you cannot deduct VAT on business expenses and investments.

VAT on goods and services to foreign countries

Do you supply goods or services abroad that are not exempt from VAT? Then different rules apply, depending on the country where your customer is located and your turnover. You calculate the Dutch or foreign VAT. And you must file VAT returns in the Netherlands or abroad. Use the Goods Abroad and Services in and out of the country tools to determine what you need to do for VAT.

Paying or reclaiming VAT

After you have completed the return, you will see in your return the amount of VAT you have to pay or that you will get back. You will not receive an assessment, but you must transfer the VAT amount to tax authorities yourself. With us you get a clear overview sent by mail which shows in the easiest way where, how and how much to pay. It’s a piece of cake.

Not clear enough?

If you do have any questions or concerns, or would like to know more, click here to book an appointment with us. If you would like to get in touch, or if you would like to file your sales tax return with us, we are of course ready to assist you.

Dit bericht is ook beschikbaar in:

![]() Български

Български ![]() Nederlands

Nederlands